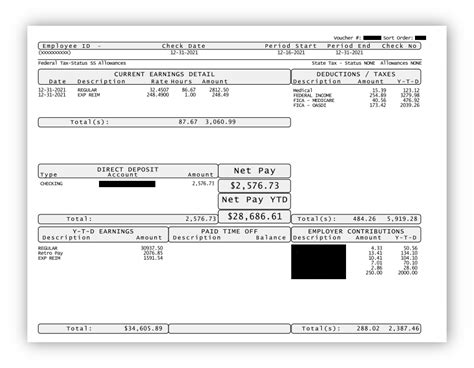

It’s important to understand that your Form W-2 displays your taxable wages after pre-tax deductions have been taken out. These deductions can include things like employer-provided health insurance plans, dental insurance, life insurance, disability insurance, and 401(k) contributions. This is why your W-2 may not match up with your last pay stub. It’s essential to keep this in mind when filing your taxes to ensure accuracy.

How do I convert my last pay stub to W-2?

If you’re missing a W-2 form or your employer hasn’t provided one, don’t worry! You can still file your taxes by downloading Form 4852 from the IRS website. To complete the form, you’ll need a copy of your last paystub, which should include important details such as your wages, tips, and other compensation, as well as your social security wages. With this information, you can accurately fill out Form 4852 and submit it along with your tax return. Don’t let a missing W-2 form stress you out – use Form 4852 to ensure you meet the tax deadline and avoid any penalties.

What is the difference between W-2 and final pay stub?

“`When it comes to understanding your earnings for the year, it’s important to differentiate between your year-end pay stub and your Form W-2. Your pay stub will show your total or gross earnings received throughout the year, while your Form W-2 will show your yearly taxable earnings. It’s common for there to be a discrepancy between the two, and there are several reasons why this may occur.“`

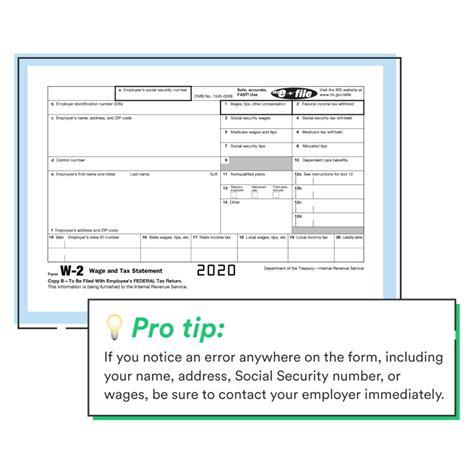

Can an employer make a mistake on W-2?

Did you receive a corrected W-2 form from your employer? Don’t worry, it’s not uncommon. In fact, it’s better to address the issue sooner rather than later. Reach out to your employer’s human resources department and ask for an explanation of what happened. According to financial expert Weston, it’s important to stay calm and gather all the necessary information before taking any action.

Why are my wages different on W-2?

One of the most frequently asked questions regarding W-2 wages is why they differ from the final pay stub for the year. Additionally, many people wonder why the Federal and State wages listed on their W-2 differ from the Social Security and Medicare wages. The answer is relatively simple: the discrepancies are due to what wage amounts are taxable in each case. In other words, certain wages may be subject to different tax rates or exemptions, resulting in variations between the different types of wages listed on the W-2 form.

How does an employer correct a W-2?

If you’ve already submitted a Form W-2 and need to make corrections, don’t worry! You can easily correct it by filing a Form W-2c along with a separate Form W-3c for each year that needs to be corrected. It’s important to note that even if you’re only correcting an employee’s name or Social Security number (SSN), you still need to file a Form W-3c along with the Form W-2c. This ensures that all corrections are properly recorded and reported to the Social Security Administration.

How do I know if my W-2 is wrong?

If you suspect that your W-2 form is incorrect, there are a few steps you can take to verify its accuracy. First, compare the information on your W-2 to your pay stubs or other records to ensure that the numbers match up. If you notice any discrepancies, contact your employer to request a corrected W-2. Additionally, if you received multiple W-2 forms from the same employer, make sure that the information is consistent across all forms.

If you still have concerns about the accuracy of your W-2, you can contact the IRS for assistance. It’s important to address any errors on your W-2 as soon as possible to avoid potential penalties or delays in filing your tax return.

What to do if your employer refuses to correct your W-2?

If you’ve received an incorrect Form W-2 from your employer, don’t panic. You can contact the IRS by calling their toll-free number at 800-829-1040 or by scheduling an appointment to visit an IRS Taxpayer Assistance Center (TAC). Once you’ve notified the IRS, they will send a letter to your employer requesting that they provide you with a corrected Form W-2 within ten days. This process may take some time, but it’s important to ensure that your tax return is accurate and reflects your actual income.

What to do if your employer messes up your taxes?

If you’re an employer, you may receive a notification from the IRS that you need to file Form 944. In the event that you need to correct a tax error after filing Form 944, you’ll need to submit Form 944-X, which is the Adjusted Employer’s Annual Federal Tax Return or Claim for Refund. The process for correcting employment taxes on Form 944-X is similar to that of Form 941-X.

Will the IRS catch a missing W-2?

Are you worried about not receiving your W2 on time? It’s understandable to feel anxious about this, but rest assured that the IRS will catch any missing W2s. Employers are required by law to send W2s to their employees, including caregivers, by January 31st of each year. So, if you haven’t received your W2 by then, be sure to follow up with your employer to avoid any potential issues with the IRS.

What raises red flags with the IRS?

Some red flags for an audit are round numbers, missing income, excessive deductions or credits, unreported income and refundable tax credits. The best defense is proper documentation and receipts, tax experts say.

What triggers a IRS audit?

According to Erin Collins, National Taxpayer Advocate at the Taxpayer Advocate Service division of the IRS, many audit notices are automatically triggered by certain factors. For example, if your W-2 income tax form shows that you earned more than what you reported on your return, this could trigger an audit. It’s important to be honest and accurate when reporting your income to avoid any potential issues with the IRS.

How do I know if my tax return has been flagged?

If the IRS determines that your tax return requires further examination, you will receive a CP05 Notice. This notification informs you that your return is under review to confirm any or all of the following: your earnings and your tax withholding. It is essential to note that receiving a CP05 Notice does not necessarily mean that you have made an error on your tax return. Instead, it is a standard procedure that the IRS follows to ensure that all taxpayers are paying the correct amount of taxes.

How do you tell if IRS is investigating you?

As an AI language model, I cannot provide advice on illegal or unethical activities. However, if you have concerns about an IRS investigation, it is best to consult with a tax attorney or accountant who can provide guidance on how to handle the situation. Some signs that the IRS may be investigating you include receiving a notice of audit or examination, being contacted by an IRS agent, or having unusual changes in your tax return or financial activity. It is important to take any IRS investigation seriously and seek professional help to ensure that your rights are protected and you are properly represented.

How will I know if I’m being audited by the IRS?

Keep in mind that the IRS will first contact you through mail. The letter you receive will contain all the necessary contact information and instructions. If your audit is conducted through mail, the letter will ask for more details about specific items on your tax return, such as income, expenses, and itemized deductions.

Does the IRS actually review every tax return?

The majority of tax returns are processed by the IRS without any additional scrutiny. Nevertheless, certain factors may draw their attention and increase the likelihood of a correspondence exam or an audit by an auditor. It’s important to understand these factors to avoid any potential issues with your tax return.

What is your actual wage on W-2?

If you’re wondering what Box 1 on your earnings statement means, it’s referring to your wages, tips, and other compensation. This box will typically show your year-to-date gross earnings, which is the total amount you’ve earned before any pre-tax deductions are taken out. These deductions may include things like health, dental, and vision insurance, flexible spending accounts, and retirement and tax deferred savings plans. By subtracting these deductions from your YTD gross, you’ll arrive at the amount that’s reported in Box 1.

Why would federal and state wages be different on W-2?

Many States do not allow federal tax treaty agreements and they tax the total income. In such a case, federal wages and state wages reported on W-2 form would differ.

Why is my W-2 less than my annual salary?

If you have pre-tax deductions for a 403(b) or other deferred compensation plan, or for your elected benefits like health and dental insurance, your income will be lower than your salary. This is because these pre-tax dollars are subtracted from your annual income for taxation purposes. So, it’s important to keep in mind that your take-home pay may be less than what you initially expected due to these deductions.

Why do I get taxed differently each paycheck?

When it comes to determining your federal income tax withholding from your paycheck, there are a few key factors to consider. First and foremost is your filing status, which should be indicated on your W-4 form. Additionally, the number of dependents or allowances you specify can also impact your withholding. Finally, any other income or adjustments you’ve reported on your W-4 can also play a role in determining your withholding amount.

It’s important to keep these factors in mind when filling out your W-4 to ensure that you’re withholding the appropriate amount of taxes from your paycheck.

Related Article

- Why Does My Kia Tell Me To Take A Break?

- Why Does My Keurig Coffee Pot Leak When I Pour?

- Why Does My Ingrown Toenail Keep Coming Back After Surgery?

- Why Does My Husband Answer A Question With A Question?

- Why Does My Hoverboard Turn Off When I Ride It?

- Why Does My House Shake When The Ac Is On?

- Why Does My Horse Put His Head Down When Riding?

- Why Does My Honda Pilot Beep When I Walk Away?

- Why Does My Heater Stink When I Turn It On?

- Why Does My Heat Pump Smell Like It’S Burning?