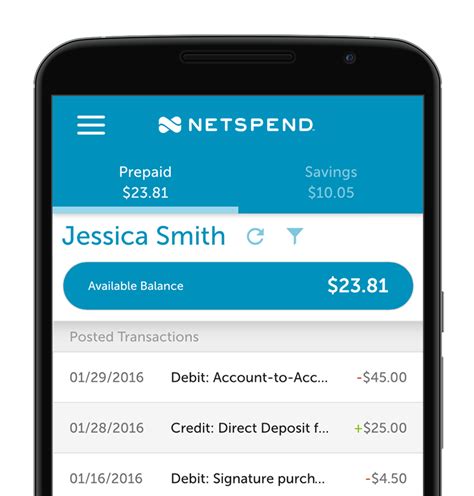

If you happen to receive a Netspend All-Access Card in your mailbox, it’s probably a result of a promotional effort. This card is a prepaid option that remains inactive until you decide to activate it. Typically, there’s no additional step required if you receive this card via mail.

What is Netspend and why did they send me a card?

Prepaid cards from Netspend offer a viable alternative to traditional checking accounts. If you have a less-than-stellar banking history that prevents you from qualifying for a checking account, a prepaid card can provide you with access to everyday spending. However, it’s important to note that these cards come with costly fees, ranging from monthly fees to charges per transaction.

Why did Netspend send me a card in the mail with my name on it?

Have you ever received a card from Netspend and wondered why? Well, it’s actually a marketing strategy to promote their prepaid debit card. Even if you didn’t request it, they may still send it to you. However, the card is not active until you verify your identity and load money onto it. So, if you’re not interested, you can simply discard it.

It’s important to note that this practice is legal and common among financial institutions.

Did the IRS send me a Netspend card?

“Have you received prepaid debit cards from the IRS? If you have, then you have received the Economic Impact Payment Card, which was created by the Bureau of the Fiscal Service, a division of the Treasury Department. It’s important to carefully check your mail to ensure that you don’t miss out on this valuable resource.” (64 tokens)

Do stimulus checks come on Netspend card?

If you are currently receiving Social Security, SSI, or Railroad Retirement funds on your Netspend Card Account, you may be wondering how you will receive your Economic Impact Payment. The good news is that the IRS plans to deposit your payment directly into the same account you would normally receive your federal benefits. This means that you don’t need to take any additional steps to receive your payment, and you can expect it to arrive in the same way that you receive your regular benefits. This is a convenient and efficient way to receive your payment, and it can help ensure that you get the funds you need as quickly as possible.

What does the debit card for the stimulus check look like?

The Treasury Department has been issuing debit cards to recipients of stimulus payments, which come in white envelopes with the department’s seal. These cards have a Visa logo on the front and are issued by MetaBank, as indicated on the back. It’s important to note that just because someone received a check or debit card for their first payment, it doesn’t necessarily mean they’ll receive the same form of payment for subsequent payments.

What cards are being sent out for stimulus?

If you’re wondering what your Economic Impact Payment Card (EIP Card) is all about, it’s actually the vehicle for the financial assistance you’re receiving under the American Rescue Plan Act of 2021, COVID-related Tax Relief Act of 2020, or the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). This card is a convenient and secure way to access your funds, and it’s loaded with the amount you’re entitled to receive. So, if you’re eligible for any of these programs, be sure to keep an eye out for your EIP Card in the mail.

Why did MetaBank send me a card?

The reason why the IRS is opting for prepaid debit cards is because of its speed. According to the IRS, this method will expedite the delivery of payments to reach as many people as possible in the shortest amount of time. The Bureau of the Fiscal Service is sponsoring these cards.

Is the stimulus check coming on a MetaBank card?

If you’re waiting for your stimulus payment from the IRS, keep an eye out for the term “economic impact payment” or EIP. This is what the payment is officially referred to as. If you receive a debit card instead of a check, you’ll notice the Visa logo on the front and the issuing bank will be MetaBank, which is the Treasury Department’s financial agent. On the back of the card, you’ll see the words “Money Network.

“

Why did I receive a MetaBank?

It’s important to be aware that if you receive a debit card from MetaBank, accompanied by a note from the US Treasury Department, it’s not a scam. In fact, it could be your long-awaited $600 stimulus check. It’s crucial not to discard the card, as some individuals have mistakenly done, believing it to be fraudulent.

Does IRS send MetaBank cards?

The prepaid debit card known as the EIP Card is provided by MetaBank, N.A., which is the financial agent for the Bureau of the Fiscal Service. It’s important to note that the IRS is not responsible for deciding who receives this card.

What if I received a debit card I didn’t apply for?

If you happen to receive a debit or credit card from a bank that you have not applied for, it is important to take immediate action. The first step is to contact the bank that issued the card and inquire about the reason for its issuance. This will help you determine if it is a legitimate card or a scam. However, it is crucial to avoid using the contact numbers provided in the mail that came with the card, as they may be fraudulent.

Instead, look up the bank’s official contact information and use that to get in touch with them. By taking these precautions, you can protect yourself from potential fraud and identity theft.

Is the IRS sending debit cards instead of stimulus checks?

As of January 8, 2021, the Treasury’s Bureau of Fiscal Service is taking steps to ensure that payments are delivered to eligible individuals as quickly as possible. To achieve this, they are sending out payments via prepaid debit card. If you are eligible for a payment but do not receive a direct deposit, it is important to keep a close eye on your mail during this time. The IRS and Treasury are urging individuals to be vigilant in checking their mailboxes for these prepaid debit cards.

What kind of card does the tax refund come on?

“`When your MCTR debit card is ready, it will be delivered to you in a white envelope that features the California state seal. To start using your card, you will need to activate it by calling 1-800-240-0223.“`

Does the IRS issue debit cards for refunds?

If you chose to file your tax return on paper, you can expect to receive your payment via a debit card in the mail. This method of payment is commonly used for those who file their taxes manually. It’s important to keep an eye out for the card in your mailbox and activate it as soon as possible to access your funds.

What is Netspend card?

A Netspend card is a type of prepaid card that is not connected to a credit or debit account. It is offered by Netspend and can be operated by either Visa or Mastercard. When a customer orders a Netspend card, they can load a specific amount of money onto it and use it for various transactions. This type of card can be a convenient alternative to traditional banking methods for those who prefer to manage their finances with a prepaid option.

Why did I get a check from the IRS today?

If you receive a payment from the IRS with the description “IRS TREAS 310” and the code “TAX REF,” it is likely a refund from a filed tax return. This could include an amended tax return or an adjustment to your tax account. It’s important to note that this payment is not a scam or fraudulent activity. If you are unsure about the source of the payment, you can contact the IRS directly to confirm its legitimacy.

Why did I get a tax refund card in the mail?

If there have been any changes, closures, or updates to your bank account since you filed your 2020 California tax return, don’t worry. You will still receive your payment, but it will come in the form of a debit card sent through the mail. It’s important to note that processing can take anywhere from 10-14 weeks, so be patient. For more information on payment schedules, head to the “When you’ll receive your payment” section on our website.

Will IRS deposit stimulus on prepaid card?

In order to expedite the distribution of payments and ensure that as many people as possible receive them quickly, the Bureau of Fiscal Service within the Treasury is utilizing prepaid debit cards to send out the funds. The IRS and Treasury are advising those who are eligible for the payments but do not receive a direct deposit to be vigilant in checking their mail during this time.

How does stimulus check appear in direct deposit?

When it comes to receiving direct deposit payments from the IRS, the process is relatively straightforward. The agency utilizes information that is already on file to determine which bank account to send the payment to. This typically involves attaching a routing and account number to your most recent tax filing, whether that be from 2020 or 2019. Additionally, if you received the first stimulus check earlier in 2020, you likely provided your bank account information at that time as well.

By using this existing data, the IRS can quickly and efficiently distribute payments to eligible individuals.

What kind of card does the tax refund come on?

If you’ve recently applied for an MCTR debit card, keep an eye out for a white envelope with the California state seal on it. This is where your card will arrive. Once you have it in hand, you’ll need to activate it before you can start using it. Simply call 1-800-240-0223 to complete the activation process.

How does stimulus direct deposit show up?

If you’re expecting a stimulus payment from the IRS, you may see the label “ACH CREDIT IRS TREAS TAX EIP” on your direct deposit. Don’t worry, this is just the first round of payments. To check the timing and form of your payment, use the IRS “Get My Payment” tool. It’s possible that you may receive a debit card or a check instead of a direct deposit, so don’t be caught off guard.

Related Article

- why did chris and alene leave dr seuss baking challenge

- why d you come in here lookin like that lyrics

- why cant i use my cash app card with uber

- why can’t i listen to music while on facebook

- why are tires in the shape of circles dad joke

- why are the tips of my peace lily turning brown

- why are flags at half staff today march 28 2023

- why isn’t dr. kristen on pitbulls and parolees anymore

- why is my roku tv blinking red at the bottom

- why does my window squeak when i roll it down