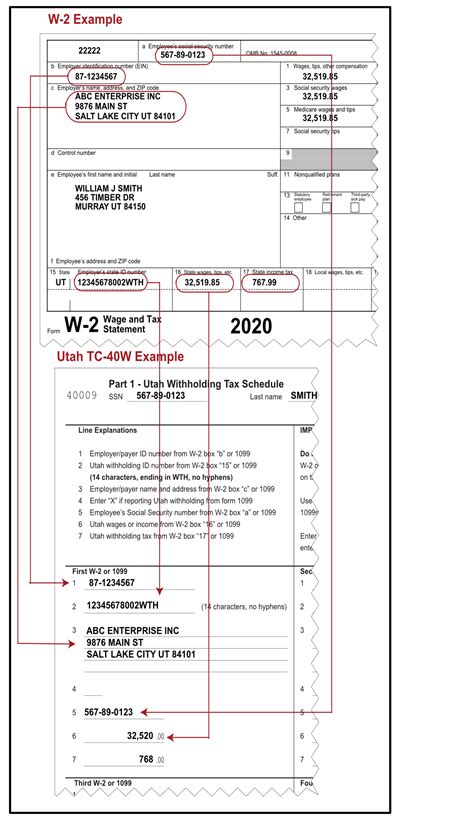

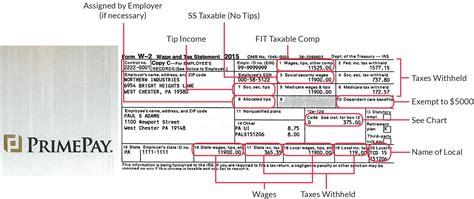

It’s important to understand that your Form W-2 displays your taxable wages after pre-tax deductions have been taken out. These deductions can include things like employer-provided health insurance plans, dental insurance, life insurance, disability insurance, and 401(k) contributions. This is why your W-2 may not match up with your last pay stub. It’s essential to keep this in mind when filing your taxes to ensure accuracy.

Why is my W-2 not matching my salary?

It’s common to feel confused when your W2 doesn’t match your salary. However, it’s important to understand that your salary is the total amount you earned before taxes and deductions, while your W2 shows your taxable income after pre-tax deductions. This means that your W2 will always be lower than your salary. It’s essential to keep track of your pre-tax deductions, such as health insurance and retirement contributions, to ensure that your W2 accurately reflects your taxable income.

By understanding the difference between your salary and W2, you can avoid any surprises when tax season rolls around.

Why is my W-2 wages higher than my salary?

One of the most frequently asked questions regarding W-2 wages is why they differ from the final pay stub for the year. Additionally, many people wonder why the Federal and State wages listed on their W-2 differ from the Social Security and Medicare wages. The answer is relatively simple: the discrepancies are due to what wage amounts are taxable in each case. In other words, certain wages may be subject to different tax rates or exemptions, resulting in variations between the different wage categories.

What is my actual salary on W-2?

If you’re wondering how to calculate your total salary for federal income tax purposes, Box 1 of the W-2 form is where you’ll find the answer. This box displays your taxable wages, which you can use to determine your overall income. To get your total salary, you’ll need to add the amount shown in Box 1 to your nontaxable wages and any pretax deductions that are exempt from federal income tax. By doing this, you’ll have a clear understanding of your income and be able to accurately file your taxes.

Why does my gross pay not equal my salary?

Triple-delimited paragraph:

“`Determining an employee’s gross pay can be done in two ways: hourly pay or a set weekly salary. Even if an employee is paid by the hour, they still earn gross pay. This means that they receive a certain amount of pay for the hours they work. It’s important to note that earning a salary is not a requirement for receiving gross pay.

Regardless of the payment structure, all employees are entitled to receive their gross pay for the work they have done.“`

What is the annual salary for $17 an hour?

The annual salary for $17 an hour depends on the number of hours worked per week and the number of weeks worked per year. Assuming a full-time work schedule of 40 hours per week and 52 weeks per year, the annual salary would be $35,360. However, if the employee works part-time or takes time off, the annual salary would be lower. It’s important to note that taxes and other deductions may also impact the final salary amount.

It’s always a good idea to consult with a financial advisor or use a salary calculator to get a more accurate estimate of annual salary.

Why is my paycheck less than I calculated?

Triple-delimited paragraph:

“`Understanding Tax Exemptions

When filling out your W-4 form, the number of exemptions you claim can have a significant impact on the amount of taxes that are withheld from your paycheck. If you choose to claim fewer exemptions, a larger amount of money will be deducted from each paycheck. Conversely, if you claim more exemptions, a smaller amount of money will be withheld. It’s important to carefully consider the number of exemptions you claim to ensure that you’re not overpaying or underpaying your taxes throughout the year.

“`

Why is my biweekly pay less than my salary?

The reason for the hourly difference between biweekly and semi-monthly pay periods is due to the number of paychecks each employee receives. Biweekly employees receive 26 paychecks per year, while semi-monthly employees receive 24 paychecks. To calculate the hourly rate for a biweekly employee, you would divide the annual salary by 2,080 (the number of hours worked in a year for a full-time employee) and then divide that number by 26. For a semi-monthly employee, you would divide the annual salary by 2,080 and then divide that number by 24.

What to do if your paycheck seems wrong?

As an employee, it’s important to keep an eye on your paycheck and report any errors to your employer promptly. Be sure to clearly communicate the issue and provide a copy of your pay stub as evidence. This will allow management or HR to address the problem quickly and ensure that you receive the correct amount of pay. Don’t hesitate to speak up if you notice any discrepancies, as it’s your right to receive accurate compensation for your work.

How do I know if my paycheck is wrong?

If you suspect that your paycheck is incorrect, there are a few steps you can take to verify this. First, review your pay stub and ensure that all of the information is accurate, including your hours worked, rate of pay, and any deductions or taxes. If you notice any discrepancies, bring them to the attention of your employer or HR department. Additionally, you can compare your current paycheck to previous ones to see if there are any significant changes.

If you still have concerns, you can contact your state’s labor department or consult with a legal professional. It’s important to address any issues with your paycheck promptly to ensure that you receive the correct compensation for your work.

What is paycheck deception?

In essence, laws on paycheck deception imply that the government has greater control over how union employees utilize their earnings than the employees themselves. This can be seen as a violation of workers’ rights to make their own financial decisions.

Can you get fired for being overpaid?

If an employee fails to repay overpayments, they may face termination from their job, unless there are extenuating circumstances. This is an important aspect of employment that should not be taken lightly. It is crucial for employees to understand their responsibilities when it comes to repaying any overpayments they may have received. Failure to do so can result in serious consequences, including the loss of their job.

Therefore, it is important for employees to take this obligation seriously and make every effort to repay any overpayments in a timely manner.

Why don’t jobs pay more?

Many companies are hesitant to increase wages due to the “Sticky Wages” effect, as economists often explain. This effect refers to the reluctance of management to raise wages because it becomes difficult to lower them again. Additionally, during times of economic downturn or reduced business activity, the company is left with the burden of high labor costs. This fear of being stuck with high wages is a common reason why companies are hesitant to increase employee compensation.

Why am I getting paid less than new hires?

Wage compression is a phenomenon that can happen in a company due to various reasons. One of the reasons is when the company has a track record of providing infrequent raises or salary hikes. Another reason could be a change in leadership, structure, or market conditions that require the company to attract new talent by offering higher wages or better total compensation packages.

Do people work harder for higher pay?

In a recent study, it was discovered that a higher minimum wage can actually increase productivity. According to Persico, the lead researcher, employees tend to work harder per hour when they are paid a higher wage. This finding suggests that paying employees a fair wage not only benefits them financially, but can also lead to better work performance and increased productivity.

Do people work harder if they get paid more?

According to a research study published in the Human Resource Management Journal, employees who receive performance-based pay, which is linked to individual or company-wide performance, tend to work harder. However, this increased workload often leads to higher levels of stress and lower job satisfaction.

Is your gross pay supposed to equal your salary?

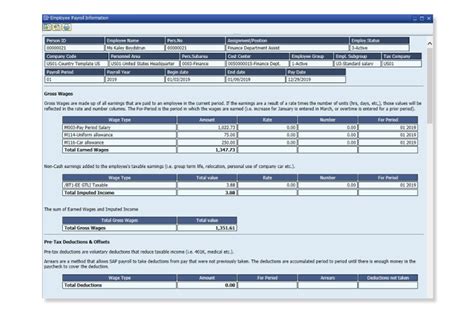

When it comes to calculating an employee’s pay, gross wages are the starting point. This refers to the total amount an employee earns before any taxes or other deductions are taken out. In most cases, an employee’s gross wages will primarily consist of their base pay, which can include their salary, hourly wage, or tips (if they work in a tip-based industry). Essentially, gross wages are the amount an employee earns before any adjustments are made.

Should my gross pay equal my annual salary?

If you’re looking for a natural way to reduce stress levels, meditation may be the answer. Meditation is a practice that involves focusing your attention on a particular object, thought, or activity to achieve a state of mental clarity and relaxation. Research has shown that regular meditation can help reduce stress, anxiety, and depression, as well as improve overall well-being. Whether you’re a busy professional, a stay-at-home parent, or a student, incorporating meditation into your daily routine can help you feel more calm, centered, and focused.

So why not give it a try and see how it can benefit your life?

Should gross income equal salary?

When it comes to calculating an employee’s earnings, gross pay is the starting point. This figure represents the total amount an employee earns before any deductions are taken out, such as taxes, benefits, or wage attachments. It’s important to note that gross pay includes not only an employee’s base salary or hourly wage, but also any additional compensation they may receive, such as bonuses, commissions, reimbursements, or overtime pay. This information is typically reflected on an employee’s pay stub, providing a clear breakdown of their earnings for the pay period.

Why is my gross pay different each month?

When it comes to income, it’s crucial to understand the difference between gross monthly salary and net monthly income. Your gross salary is the amount you earn before any deductions, while your net income is what you actually take home after taxes and other necessary deductions are made. It’s important to keep this in mind when budgeting and planning your finances, as your net income is the amount you have available to cover your expenses and save for the future.

Related Article

- Why Does Vyvanse Make Me Poop?

- Why Does Victoria Secret Sell Uggs?

- Why Does Vetiver Smell So Bad?

- Why Does Vaping Make Me Sneeze?

- Why Does Vaping Make Me Burp?

- Why Does Vaping Burn My Throat?

- Why Does Vape Make Me Dizzy?

- Why Does Vape Juice Turn Brown?

- Why Does Vape Burn My Throat?

- Why Does Valorant Update Keep Pausing?