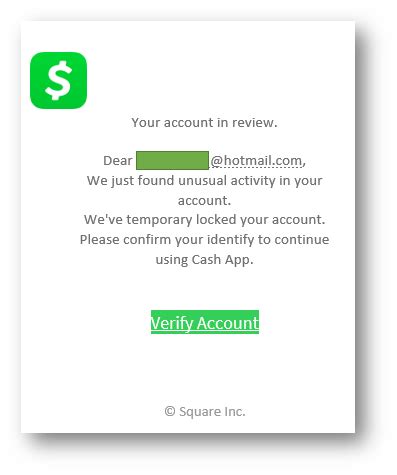

If you’re unable to find the Paper Money option in your app, there’s a good chance that you’re using an outdated version. This feature is relatively new, so you’ll need to ensure that you have the latest version of the app installed to access it. Additionally, it’s worth considering verifying your account, as this may also help resolve the issue.

How do you get the Paper Money feature on Cash App?

If you want to access the Paper Money feature on your Cash App, it’s a simple process. All you need to do is open the app and tap on the Banking tab located on the home screen. From there, you can select the Paper Money option and start using this feature. With Paper Money, you can create a virtual credit card that can be used for online purchases or other transactions.

It’s a convenient way to manage your finances and keep track of your spending without having to worry about carrying physical cash or cards.

Where is the barcode on Cash App to add Paper Money?

There is no barcode on Cash App to add paper money. Cash App is a digital payment platform that allows users to send and receive money electronically. To add funds to your Cash App account, you can link a bank account or debit card. You can also receive money from other Cash App users.

If you have physical cash that you want to add to your Cash App account, you will need to deposit it into your bank account first and then link that account to your Cash App. There is no way to add paper money directly to your Cash App account.

How long does it take to add Paper Money to Cash App?

After the deposit of paper money is finished, the user’s Cash App balance is immediately updated with the funds.

Can you add Paper Money to Cash App at Walmart?

Yes, you can add Paper Money to Cash App at Walmart. To do so, you need to go to the Walmart Money Center or Customer Service Desk and ask for a Cash App card. Once you have the card, you can add funds to your Cash App account by using the card at any Walmart register. Simply swipe the card and enter the amount you want to add.

The funds will be added to your Cash App account instantly. It’s important to note that there may be fees associated with adding funds to your Cash App account at Walmart, so be sure to check with the store before you make a transaction.

How do I add money to my Cash App without a debit card?

Unfortunately, it is not possible to add money to your Cash App account without a debit card. Cash App requires a linked debit card to make transactions and add funds to your account. However, you can link a credit card or bank account to your Cash App account to add funds. Additionally, you can receive money from other Cash App users or transfer funds from your linked bank account to your Cash App account.

It is important to note that Cash App may charge fees for certain transactions, so be sure to review their terms and conditions before adding funds to your account.

Can you add Paper Money to Cash App at CVS?

It used to be that the only way to load money onto your Cash App card was through your debit card or bank account. However, things have changed and now you can add funds to your card at many larger convenience stores such as Walmart, Dollar General, CVS, and 7-Eleven. This makes it much more convenient for users who may not have access to a bank account or prefer to load their card in person rather than online.

How much does it cost to add Paper Money to Cash App?

If you’re looking to deposit funds into your account, you have two options: standard or instant deposits. Standard deposits are completely free and typically arrive within 1-3 business days. However, if you need the funds immediately, you can opt for an instant deposit. Keep in mind that instant deposits do come with a fee of 0.

5% – 1.75% (with a minimum fee of $0.25), but the funds will arrive instantly to your debit card. It’s important to weigh the pros and cons of each option before making a decision.

Is there a fee to add Paper Money to Cash App card?

If you’re planning to deposit paper money using the mobile app, keep in mind that there’s a $1 fee for each deposit. Additionally, you can only make one transaction per barcode. If you need to deposit more than $500, you’ll have to generate a new barcode by completing the first transaction, tapping Done, and then selecting the location on the map again to show a new barcode. It’s important to note these details to avoid any confusion or frustration during the deposit process.

How do I put money on my Cash App card at an ATM?

Unfortunately, it is not possible to put money on your Cash App card at an ATM. The only way to add funds to your Cash App card is through a linked bank account or by receiving money from another Cash App user. However, you can use your Cash App card to withdraw cash from an ATM that accepts Visa. Simply insert your card, enter your PIN, and select the amount you wish to withdraw.

Keep in mind that there may be fees associated with ATM withdrawals, so be sure to check with your bank and the ATM provider before making a withdrawal.

Can I use ATM with Cash App?

If you’re looking for a convenient and cost-effective way to withdraw cash, Cash App might be the solution you need. With this app, you can enjoy unlimited free withdrawals at in-network ATMs, which means you won’t have to worry about paying extra fees or charges. Additionally, if you receive $300 or more in paychecks directly deposited into your Cash App account in a given calendar month, you’ll be eligible for one instantly reimbursed out-of-network withdrawal per 31 days. This feature can be a lifesaver if you need cash in a pinch and don’t have access to an in-network ATM.

Overall, Cash App’s withdrawal options are designed to make your life easier and more affordable, so you can focus on the things that matter most.

Can Cash App work on ATM?

No, Cash App cannot work on an ATM. Cash App is a mobile payment service that allows users to send and receive money through their mobile devices. While Cash App does offer a debit card that can be used at ATMs, the card is linked to the user’s Cash App account and not the app itself. Therefore, users must have funds available in their Cash App account in order to withdraw cash from an ATM using their Cash App debit card.

It is important to note that Cash App may charge fees for ATM withdrawals and users should check with their bank or financial institution for any additional fees that may apply.

Does Cash App card work with ATM?

If you have a Cash Card, you can easily withdraw cash from any ATM using your Cash PIN. However, it’s important to note that withdrawing funds from your ‘Savings’ balance is not supported. When prompted, make sure to select the ‘Checking’ account option to complete your transaction successfully. With the convenience of using your Cash Card, you can access your funds whenever you need them without any hassle.

What are 3 ways to withdraw money?

Many ATMs, particularly those within bank networks, offer the convenience of cardless withdrawals through mobile banking apps or mobile wallets. If you prefer to have cash on hand, you can also cash a cheque, receive cashback at a store, or visit your bank in person to withdraw funds. However, keep in mind that some of these options may come with additional fees.

Can you send $1000 on Cash App?

If you’re looking for a convenient way to send and receive money, Cash App might be the solution for you. With Cash App, you can easily transfer up to $1,000 within a 30-day period. However, if you verify your identity by providing your full name, date of birth, and Social Security number, you’ll be able to enjoy higher limits. This makes Cash App a great option for those who need to send or receive larger amounts of money quickly and securely.

Can I use my Cash App card internationally?

Unfortunately, Cash App is currently only available in the United States and the United Kingdom. This payment application solely permits users to transfer funds from one US or British bank account to another, which implies that both the sender and the receiver must possess bank accounts in either of these two countries.

Can I load Cash App at Walgreens?

Yes, you can load Cash App at Walgreens. To do so, you need to have a Cash App card and visit a Walgreens store that offers the service. Simply give your Cash App card to the cashier and tell them how much you want to load onto it. There may be a fee for this service, so be sure to check with the store beforehand.

It’s important to note that not all Walgreens locations offer Cash App loading services, so it’s best to call ahead or check online to find a store near you that does.

Does Walmart take Cash App without card?

With the rise of digital payment methods, making purchases has become more convenient than ever before. Not only is it easier and faster, but it’s also safer. You no longer need to carry your physical wallet with you, just your cell phone. Using Cash App, for example, you can pay in a store without a card by using your $Cashtag.

This means you won’t have to make contact with anyone in the store, as the payment will be processed through your own Cash App account. Overall, digital payment methods have revolutionized the way we make purchases, making it more efficient and secure.

Can you add money to Cash App at Dollar General?

Yes, you can add money to your Cash App account at Dollar General. Simply visit any Dollar General store and ask the cashier to add money to your Cash App account. You will need to provide your Cash App account number or scan the QR code on your Cash App mobile app to complete the transaction. There may be a small fee for this service, so be sure to check with the cashier before proceeding.

It’s important to note that not all Dollar General stores offer this service, so it’s best to call ahead or check the Cash App website for a list of participating locations.

Where can I add money to my Walmart card?

There are several convenient ways to load funds onto your MoneyCard. You can do so at store registers, Walmart MoneyCenters, or even with your IRS tax refund. These options make it easy to add money to your card and ensure that you always have access to your funds when you need them.

Related Article

- Why Does My Cash App Keep Saying Invalid Card Number?

- Why Does My Car Swerve When I Hit A Bump?

- Why Does My Car Sway When I Hit A Bump?

- Why Does My Car Start Sometimes And Not Other Times?

- Why Does My Car Sound Like A Wind Up Toy?

- Why Does My Car Sound Like A Remote Control Car?

- Why Does My Car Sound Like A Helicopter When Idling?

- Why Does My Car Rev When I Turn The Wheel?

- Why Does My Car Radio Keep Turning Off And On?

- Why Does My Car Lock Itself When I Unlock It?